First Global Competition to Empower Women-led Startups Attracts 119 Registrants from 20 Countries

We are inspired by the incredible response from the global InsurTech community to Quesnay’s Female Founders in InsurTech Competition - the first global competition for women-led startups in insurance. The 73 qualifying applicants captured a wide spectrum of innovative solutions that tackled the industry’s most pressing problems. From mobile micro-insurance in Kenya to AI-powered claims and underwriting in Israel, these startups are on the cutting edge of technology within the insurance industry.

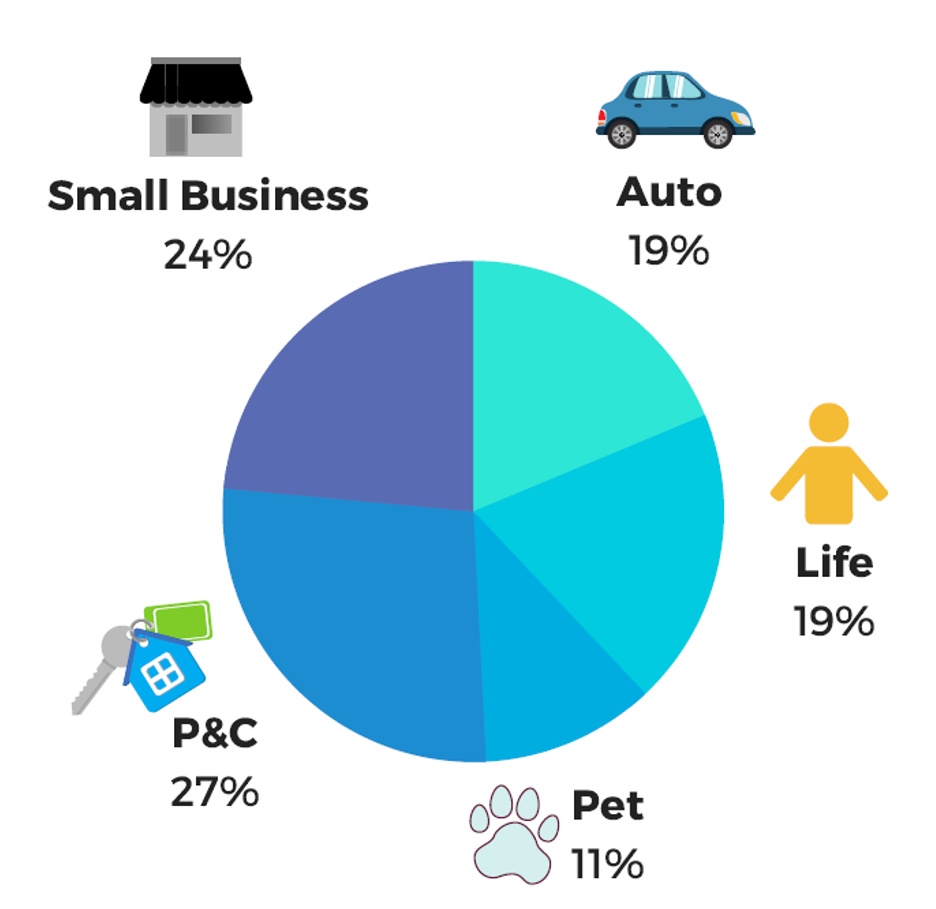

Profile of applicants for the Female Founders in InsurTech competition

The competition was fierce. With over $75,000 in cash prizes and in-kind support, mentorship, and exposure to leading insurance giants like Farmers Insurance, CSAA, Liberty Mutual, RGAX, and QBE on the line, the quality of the applications that came in were exceptionally strong as validated by our judges.

“What a group of inspiring women! So glad I could be a part of the judging.”

- Terri Grijalva, Senior Director, Liberty Mutual

“If what I witnessed is any indication, female leaders in technology are going to more than do their part in leading the charge in shaping innovative technology solutions for generations to come.”

- Kartik Sakthivel, CIO, LIMRA & LOMA

Over 100 leaders from 65 companies judged the 73 qualifying applications. Some of our other featured judges include: Rehan Ashroff, Director of Innovation Lab at Farmers Insurance Group (our presenting sponsor); John Heveran, SVP and CIO of Commercial Insurance at Liberty Mutual Insurance (supporting sponsor); Kelle Bub, Innovation Manager at RGAX (supporting sponsor); Vivian Li, Principal of Corporate VC & Labs at CSAA Insurance Group (supporting sponsor); and Ashley Becker, Head of Innovation Programs at QBE Insurance Group (contributing sponsor).

After a rigorous three-week evaluation process, the following women-led startups have been selected to pitch at InsureTech Connect, the world’s premier insurtech conference, in Las Vegas on October 1st. You can RSVP for the event here and register at a discounted rate for InsureTech Connect here. Prior to this capstone event, our finalists will have the opportunity to be coached and mentored by leading insurance executives and industry experts.

Meet the 5 finalists!

Co-Founder: Shruthi Rao

Adapt Ready is an intuitive, easy-to-use web interface with sophisticated visualization, data/geospatial analytics, and modelling to run what-if scenarios – all bundled in a platform that provides a 360-degree view of the risk exposure. The platform, Aria, is designed with data security as a top priority, reducing the time to implementation.

Adapt Ready can combine an insurer’s book with the power of external data to determine hidden risks/exposures that can be used as a strategic sales tool for underwriting new policies or at renewal.

Co-Founder: Malgorzata Stys

Dreyev (pronounced “Drive”) is the most advanced solution for fleets and insurers to prevent crashes caused by inattentive driving. Unlike existing solutions, Dreyev creates driving behavior models to anticipate upcoming risks and generate personalized, urgency-triggered alerts in real-time. Dreyev evaluates responsiveness of the driver and effectiveness of the corrective actions in order to maximize timeliness and effectiveness of these alerts.

Improvements for insurance stem from monitoring driving habits, issuing real-time driver performance feedback, the tracking of safety performance, and providing drivers with real-time safety coaching tools. This will allow insurers to better understand driver propensity to risk and offer more competitive risk-based premiums.

Co-Founder: Juliette Murphy

FloodMapp is an intelligent flood alert solution which helps insurers reduce their flood damages, whilst improving the safety of policyholders. FloodMapp provides users with more warning time and personalized messaging -- allowing them to ensure the safety of their pets, valuables, and minimize flood damage. In addition, by translating flood heights into an interactive live flood map, users can easily comprehend the severity of the disaster and prepare.

FloodMapp alerts help insurers reduce flood losses by up to 50% and improve operational efficiency by: analyzing live flood mapping, predictive claims analysis, overlaying damage curves to estimate damages and reinsurance requirements, streamlining claims logistics, and resource planning.

Founder: Janthana Kaenprakhamroy

Tapoly offers on-demand insurance for freelancers, contractors, small to midsize enterprises, and anyone else in the sharing economy. There is an unmet need for freelance workers to have insurance on demand that suits individual projects. Insurance companies would have to incur massive administration overheads to set up potentially hundreds of different policies for each customer every year and this cost is passed on to customers as expensive premiums.

Tapoly offers customers flexible insurance products that perfectly suit their risks -- saving them both time and money. Tapoly launched in the UK in July 2018, with rapid expansion plans for Germany and France.

Founder: Christy Lane

Vivametrica uses sensor data from wearable devices and smartphones to provide scientifically valid health and mortality risk scores for individuals. Vivametrica’s suite of wellness and risk algorithms is developed upon scientific research and analysis, without the need for lengthy and expensive blood tests and lab work. Compared to traditional underwriting methods, Vivametrica is much more accurate at predicting mortality.

Vivametrica provides insurers with the ability to conduct real-time digital underwriting using just a smartphone. Based on early actuarial analysis, insurers can save upwards of 20% on their life insurance payouts through superior risk assessment, as well as up to $300 per applicant in underwriting costs.